The first half of 2020 has seen elevated volatility due to the virus. From peaking at all-time highs in mid-Feb, the S&P fell 30% by March 23rd then rebounding hard to close to flat for the year at the end of June.owever, within the index of 500 companies, it has been a much more divergent picture. As a repeat of the overall story of the last decade, ‘growth’ companies have continued to vastly outperform ‘value’ companies.

Now the top 3 companies are 16.5% of the index (Microsoft 6%, Apple 5.7%, Amazon 4.7%). They have averaged 37% YTD returns and added 6% to the overall S&P return. i.e. if you remove just 3 of the companies from the basket of 500, the index would be 6% lower.

Undoubtedly these are incredibly high-quality companies. But they also appear to be very highly valued too.

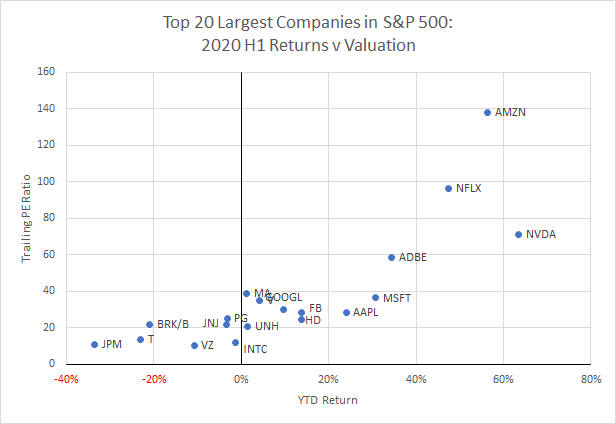

If we use P/E ratio as a crude yardstick for value, the correlation between ‘high valuation’ and YTD performance is quite incredible.

Looking at the largest 20 companies in the S&P, on a trailing P/E basis:

Or on a forward P/E basis:

And if we look at top 100 companies:

It is a subjective debate as to whether for instance Netflix at 63 forward P/E or Amazon at 75 forward P/E valuations will turn out to be good future investments in the next 10 years. We can only just say that from a stock performance perspective the gap between ‘growth’ and ‘value’ companies has only increased further so far in 2020.